How to Sync Customer Data in Salesforce Quickbooks

Businesses of today expect teams to work on activities that really matter, always keep focus on key KPIs and not be bogged down with tasks that have no value addition in the larger scheme of things. This requires various departments to have business process automations in place that save them time without the need for human intervention. The teams are also looking to automate activities that are time intensive yet are not strategic, i.e. moving data between sales and accounting systems, constant communications with customers/vendors, or even pulling out reports as and when needed.

This automation allows teams to access real-time financial data and better understand customer/vendor behavior, while accounting teams gain insights into sales and help with revenue prediction and cash flow management. Automation as simple as CRM to Accounting can help businesses automate payments and invoicing when a new opportunity closes and the buck passes to the back office to process orders and payments.

Why Automate Data Sync Across Salesforce Quickbooks

Repetitive tasks like double data entry hamper productivity and incur unnecessary costs by distracting teams from core goals. Despite using multiple apps, data silos persist across departments that spend significant time on follow-ups instead of acting on the latest data. Integrating CRM with accounting apps eliminates silos – any sales data update prompts equivalent entries in QuickBooks for invoicing/payment follow-ups. A win-win: sales tracks new order payments in CRM while finance gains sales insights for cash flow management. Read this partner case study on salesforce and quickbooks integration.

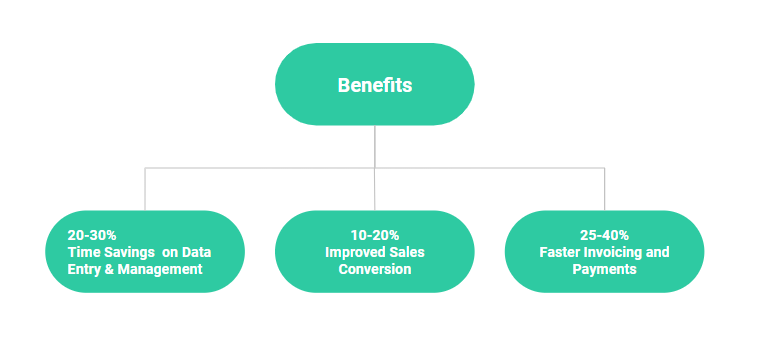

- Better Data Management: When Salesforce and Quickbooks are in sync businesses are confident that they are not missing out on revenue and simultaneously their teams are not spending time on non-core tasks

- Smoother Invoice and Payment Process: Linking these two systems simplifies how invoices and payments are tracked. Estimates made in Salesforce can be automatically sent to QuickBooks. Then, invoice information from QuickBooks can be viewed right back in Salesforce. This helps teams stay up-to-date with payments, which is good for managing money coming in and out.

- Improved Business Visibility: This integration also means businesses can see their data more clearly. Sales information from Salesforce and financial details from QuickBooks can be compared and analyzed together. This leads to better reports and a clearer picture of how the business is doing financially and in its customer relationships.

What Options to Automate Data Sync

When it comes to automating data sync between Salesforce and QuickBooks, businesses have several options to consider, each with its own level of effort, benefits, and drawbacks. Let’s explore the top three methods and their respective pros and cons and then subtly consider why a no-code middleware solution is often the preferred choice.

1. Manual Data Entry

- Effort Level: High

- Pros: No need for additional software or technical expertise.

- Cons: Extremely time-consuming, prone to human error, not scalable, and inefficient for ongoing data management.

- Verdict: It is suitable for very small businesses with minimal transactions but generally impractical and risky for any growing company.

2. Custom Integration (Developed In-House or Outsourced)

- Effort Level: Very High

- Pros: Can be tailored precisely to specific business needs, offering high flexibility.

- Cons: Requires significant upfront and ongoing investment in skilled development resources, both in terms of time and money. Maintenance can be complex, and the solution may need frequent updates to remain compatible with Salesforce and QuickBooks updates.

- Verdict: Best for large enterprises with unique requirements and the budget to support bespoke development and maintenance.

3. No-Code Middleware Platforms (Third-Party Tools)

- Effort Level: Low

- Pros: Quick to implement, user-friendly, requires no technical expertise, scalable, and automatically updated to stay in sync with Salesforce and QuickBooks updates. Often comes with robust customer support.

- Cons: Subscription costs and potential limitations in customization when compared to a bespoke solution.

- Verdict: Ideal for most small to medium-sized businesses and even larger enterprises looking for a balance between functionality, ease of use, and cost.

Building upon the advantages of no-code middleware solutions, our platform, Cloud Workflow, stands out in automating data workflows between Salesforce and QuickBooks. DBSync Cloud Workflow offers prebuilt templates, which are game-changers in this integration. These templates come with predefined data mappings, significantly simplifying the integration process.

How Cloud Workflow Effortlessly Automates Sync

- Prebuilt Templates with Predefined Data Mappings: These templates eliminate the guesswork and technical expertise usually required in setting up integrations. They are designed to cover common use cases and workflows, ensuring a smooth, error-free integration experience.

- Intuitive Q&A-Based Forms for Customization: Cloud Workflow employs an easy-to-use, question-and-answer style interface that guides you through customizing your integration. This means you can easily map data fields between Salesforce and QuickBooks without needing any technical knowledge. The process is straightforward – answer questions, and the system configures the integration for you.

- Beyond Basic Integration –

- Automating Routine Tasks: Cloud Workflow goes beyond data syncing. It enables the automation of frequent tasks across sales or finance departments. For instance, you can set up automated communications to customers for aging invoices, enhancing your accounts receivable process. This proactive approach to customer communication can significantly improve cash flow.

- Scheduled Reporting to Stakeholders: Another powerful feature is the ability to schedule and send reports automatically to key stakeholders at predetermined times. Whether it’s daily sales reports, weekly financial summaries, or monthly performance analyses, Cloud Workflow can handle this automatically, ensuring that your team and stakeholders are always informed of the latest data.

Effective business automation goes beyond just syncing data between systems like Salesforce-QuickBooks. It involves a comprehensive understanding of your company’s entire workflow and the roles different teams play. By mapping out these end-to-end processes, you can identify key areas where automation can have the most impact, not just in terms of efficiency, but in empowering employees to focus on higher-value tasks. This holistic approach ensures that your automation efforts are not just a temporary fix, but a sustainable part of your business growth, adapting and evolving with your organization’s needs.